M&A

Our M&A section offers a comprehensive guide to understanding the strategies, risks, and rewards of corporate consolidation.

Navigating the high-stakes arena of mergers and acquisitions requires a balance of strategic foresight, financial acumen, and expert negotiation. Our Merger and Acquisition section is designed to serve as your comprehensive resource for successfully orchestrating these complex business manoeuvres.

M&A

M&AE-House (China) Holdings Limited, a leading real estate services company in China, today announced that it has entered into a definitive Agreement and Plan of with E-House Holdings Ltd. and E-House Merger Sub Ltd.

M&A

M&AICAP plc (IAP.L), a leading markets operator and provider of post trade risk mitigation and information services, announces today that it has acquired ENSO Financial Analytics (ENSO).

Finance

Finance2015 was a fantastic year for Consulting sector M&A deals! According to Equiteq’s Global Consulting Mergers & Acquisitions Report 2016, deal activity in the sector grew by 9.4%, continuing an upward trend in deal activity and multiples.

Finance

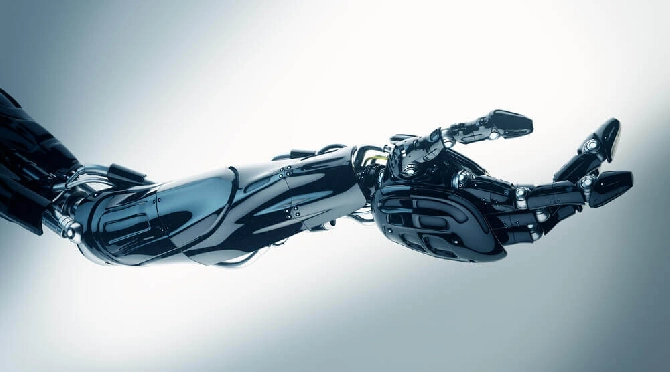

FinanceLivingston-based Touch Bionics, the developer and manufacturer of world-leading upper limb prosthetic technologies, has been sold by its shareholders to Össur Hf, the Iceland-based provider of prosthetic, bracing and supports solutions, for a consideration of

Finance

FinanceWarburg-HIH Invest Real Estate GmbH (Warburg-HIH Invest) has acquired the office property Prime Corporate Center in the city centre of Warsaw.

M&A

M&ACitius Pharmaceuticals, Inc.today announced completion of the acquisition of Leonard-Meron Biosciences, Inc.

Legal

LegalOn Mergers and Acquisitions David Gibbons, Partner, Global Head, Corporate Practice said that despite being off last year’s record pace, the M&A market continues to have a healthy outlook.

M&A

M&APenFed Credit Union, nearly $20 billion in assets, 1.4 million members and headquartered in Alexandria, Virginia, announced that it will merge with the Woodbridge, Virginia headquartered Belvoir Federal Credit Union, which has $320 million in assets and more t

M&A

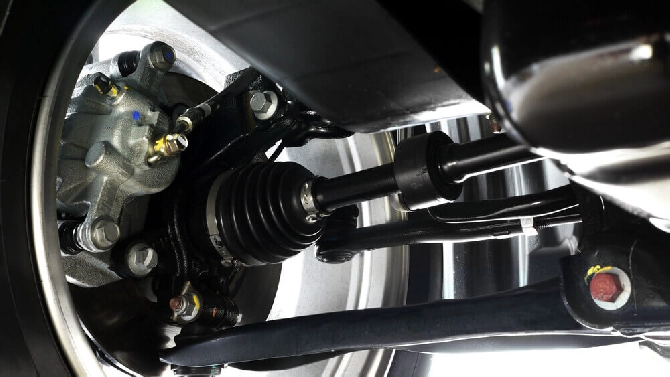

M&ASchwartz Advisors, an M&A advisory and strategic planning firm for the automotive aftermarket, announced that the firm has acted as exclusive sell-side advisor to Olympus Imported Auto Parts.

Our Legal section provides expert insights into compliance, intellectual property, contracts, and more.

LeadershipLeadership

LeadershipLeadershipOur Leadership section offers valuable insights into team management, strategic decision-making, and organisational culture.

StrategyStrategy

StrategyStrategyOur Strategy section offers insights into market analysis, competitive positioning, and long-term goal setting.

FinanceFinance

FinanceFinanceOur Finance section provides you with invaluable insights into financial planning, investment strategies, and risk management, all tailored to help you achieve sustainable business growth.

Corporate Social ResponsibilityCorporate Social Responsibility

Corporate Social ResponsibilityCorporate Social ResponsibilityWelcome to our Corporate Social Responsibility (CSR) section, where we share our dedication to making a positive impact on society and the environment.

InnovationInnovation

InnovationInnovationOur Innovation section is dedicated to exploring groundbreaking technologies, modern business models, and inventive solutions that are shaping the corporate landscape.

- More exposure for your business

- Create more brand trust and recognition

- More leads and opportunity

Acquisition International is a flagship brand of AI Global Media. AI Global Media is a B2B enterprise and are committed to creating engaging content allowing businesses to market their services to a larger global audience. We have 14 unique brands, each of which serves a specific industry or region. Each brand covers the latest news in its sector and publishes a digital magazine and newsletter which is read by a global audience.