Blackstone Agrees to Acquire Majority of Serco’s Private Sector BPO Operations

Private equity funds managed by Blackstone today entered into a definitive agreement with Serco Group Plc to buy the majority of its private sector Business Process Outsourcing (‘BPO’) operations, the main element of which is the former Intelenet business, for a consideration of £250m, approximately INR 2,558 crores. The enterprise value of this deal represents the largest acquisition by Blackstone in India.

The business has expected annual revenues of approximately £235m (INR 2,405 crores) for this year. The company has 51,000 full time employees across 67 centres in 8 countries. The private sector BPO business provides a range of middle and back office services, and has a strong customer base of international organisations, predominantly across the financial services, insurance, telecoms, travel and healthcare sectors.

Post the change in ownership, the business will be rebranded and revived as “Intelenet Global Services.” The sale is expected to complete in the coming months, subject to customary closing conditions and approvals.

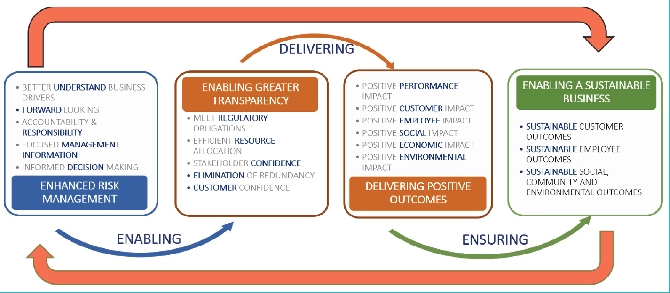

Amit Dixit, Senior Managing Director and Co-Head of Private Equity in India at Blackstone, said: “We are excited to embark on the Intelenet 2.0 journey and delighted to once again partner with the company’s management team. With a market leading position in the offshore banking and travel/hospitality verticals and #1 position in domestic India BPO, Intelenet has the core platform to capitalize on future growth opportunities. We plan to replicate the same formula for success — energize the employee base, focus on world-class operations to drive customer satisfaction, provide multi-geography and multi-language delivery, and enhance the company’s capabilities in target segments organically and inorganically.”

Susir Kumar, Chief Executive Officer, Serco Global Services, said, “We are delighted to have another opportunity to partner with Blackstone. Serco was a good owner for Intelenet and had significantly grown the BPO business in its tenure. The business however was sold because of change in strategy of Serco which led to the sale of its private sector BPO business. We have retained almost all of our clients and key staff that we have had since our inception and look forward continuing to add value to them. We will shortly be working on a strategy that will enable us to significantly enhance our offering to existing customers and prospects. With the present management team continuing, this represents a seamless change of ownership and business as usual for all our stakeholders.”

Under the terms of the transaction, the business will continue to be led by Susir Kumar, and the existing management team, which has been instrumental in the growth of the company.

About Blackstone

Blackstone is one of the world’s leading investment firms. We seek to create positive economic impact and long-term value for our investors, the companies we invest in, and the communities in which we work. We do this by using extraordinary people and flexible capital to help companies solve problems. Our asset management businesses, with over $330 billion in assets under management, include investment vehicles focused on private equity, real estate, public debt and equity, non-investment grade credit, real assets, and secondary funds, all on a global basis. Blackstone has been investing in India since 2005 and has made investments over $3 billion in private equity and real estate. Blackstone also provides various financial advisory services, including financial and strategic advisory, restructuring and reorganization advisory, and fund placement services. Further information is available at www.blackstone.com. Follow us on Twitter @Blackstone.