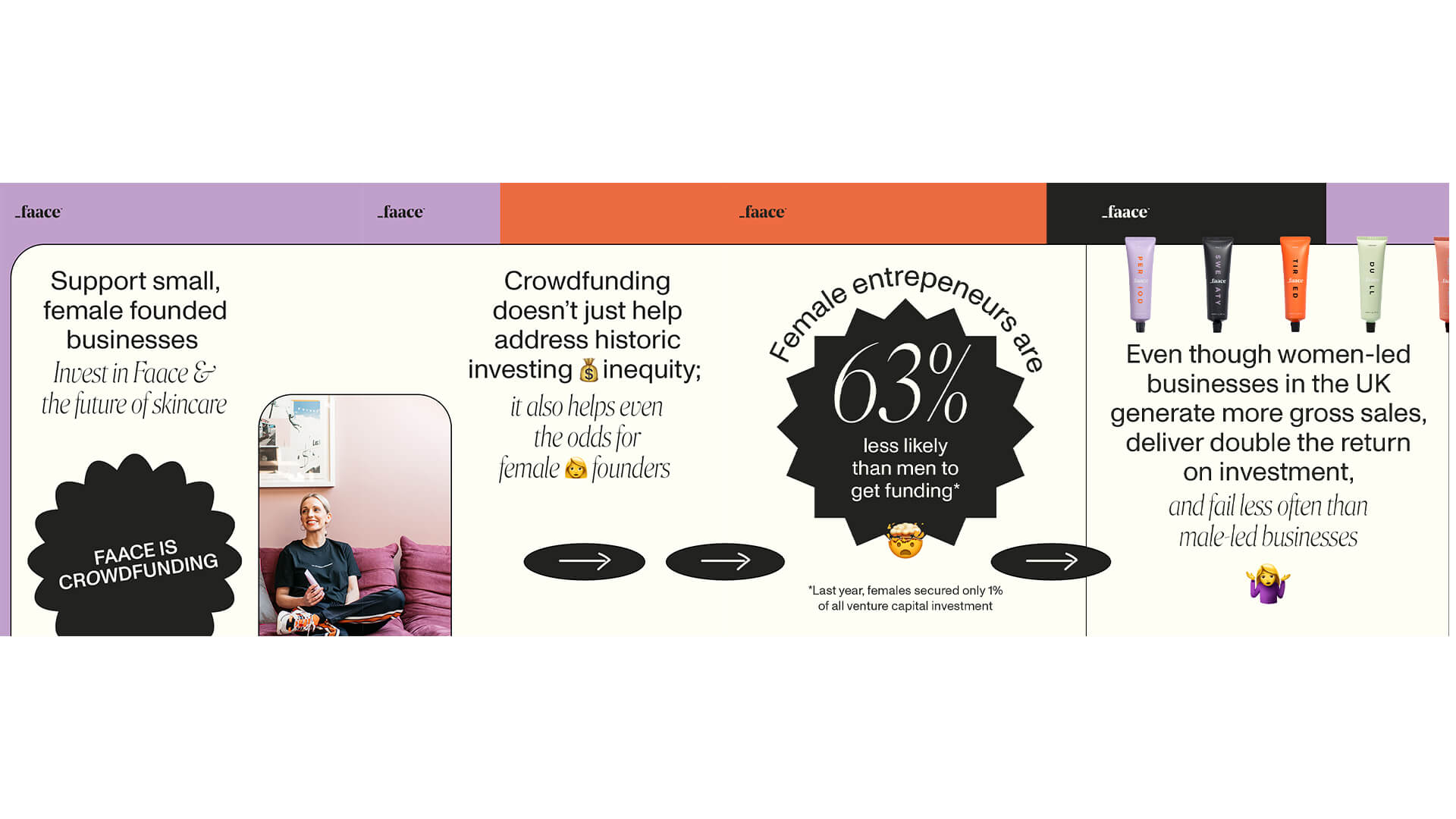

FAACE the fuss-free, ethical skincare brand for all faaces is set to launch its first Seedrs crowdfunding campaign to support global expansion plans and help tackle investing inequality

It’s widely reported that female founded businesses get less funding than male, and while venture capital boomed in 2021, women-led start-ups didn’t reap the benefits. Research from the European Investment Bank revealed that female entrepreneurs secured only 1% of venture capital investment last year. This is despite the fact that women-led businesses generate more gross sales, deliver double the return on investment, and fail less often than male-led businesses.

This is why Faace, the multi award-winning skincare brand, is launching its first crowdfunding campaign via Seedrs this December.

“Crowdfunding doesn’t just help address investing inequity; it also helps even the odds for female founders. Female entrepreneurs are typically less likely than men to get investment for their ventures, however female-led campaigns on crowdfunding platforms were found to be 32% more successful at reaching their funding target than male-led campaigns”, says Faace founder, Jasmine Wicks-Stephens.

“We’ve been inspired by fellow female-led brands in the ethical beauty and fem-care spaces like DAME and Upcircle who have experienced great success with overfunded crowdfunding campaigns and so we are excited to now invite everyone to share in our future successes as well, with investments starting from just £11”.

Taking Investing into Your Skincare to the Next Level

Born out of Jasmine’s need as a new mum for easy and effective beauty products, Faace set out to disrupt the £13billion UK beauty industry in 2020 with fuss-free, ethical skincare designed to look after your skin, when you don’t have the time or energy to do so.

In just two and half years, Jasmine’s passion project is now an award-winning (Elle, Marie Claire, Telegraph + more), results-driven skincare brand with thousands of customers around the globe. Available in 23 countries and 59 retailers from Harrods to LookFantastic, the brand has received prominent industry features from press and influencers with reach into the millions, gained a strong social and CRM community, and earned an excellent Trustpilot rating.

As a female focused brand, Jasmine is also dedicated to opening up the conversation and destigmatising topics like menopause and period, whilst supporting organisations in these sectors addressing period poverty and menopause (Hey Girls and The Menopause Charity).

To date, Faace has been largely self-funded, with investment from angel investors and a £150,000 investment awarded from the SFC Capital x The Red Tree beauty accelerator as part of a year-long collaborative partnership to help accelerate growth.

Jasmine and the team are now looking to raise upwards of £150K via crowdfunding platform Seedrs. “We’re really excited to offer shares in our business and build a larger team of cheerleaders who can support our growth and potentially benefit from it in the future”, says Jasmine. And with the next year set to be their most exciting year yet with four new products in the pipeline as well as launching into new countries and retail spaces like Selfridges and Zalando it’s an incredibly exciting time to join Faace.

If you’re thinking of creating your own start-up, these are Jasmine’s top tips on how female founders can fund their business:

Confidence is key

When pitching for investment female founders have been found to be notoriously more conservative in their revenue forecast than men, which can result in a “thanks but no thanks” from potential investors. It’s really important to be confident in yourself and your business, and while you don’t want to swing the other way and over promise on sales projections, don’t underestimate your trajectory either.

Shout about your business

Don’t be shy about your accomplishments and don’t look at shouting about your business as bragging or sharing goals as ‘desperate’ – it’s not. You’d be surprised by how many opportunities can come your way just by sharing with your network what you’re up to. LinkedIn is a really useful (and often underutilised) platform when it comes to sharing about your business – namely because you’re getting the right eyes on your posts, i.e., people in your industry who can help the growth of your business.

Network with other founders

Build a network of founders and consider them your teammates rather than rivals – even those you’re in direct competition with. Share your experiences and help people out when you can – you’ll discover that as founders you go through similar challenges, and it can be invaluable to get advice and support from one another – remember there is room for everyone!

Be strategic with your fundraising

You need to have a really good handle on your financials when it’s time to look for investors. You don’t want to start desperately pitching for funding because you’ve run out of money, it doesn’t help your cause one bit as investors will want to know you can manage your finances. Be strategic and keep assessing where you are, and where you want to be, so that when you present your figures to potential investors, they can see you’re following a well thought out expansion strategy.

Be opened minded about where investment will come from

It’s really easy to underestimate how much a product or business launch will cost. So, while you might have some money saved, it’s worth looking into other ways to help get your business up and running. Check out The Angel Investment Network, crowdfunding platforms like Seedrs, and investigate any accelerator programmes with monetary prizes attached.

The Faace crowdfund pre-registration is open now at https://www.seedrs.com/faace/coming-soon.