Creating Innovative Technologies in the Cardiovascular Space

FineHeart is a French medical device company focused on creating innovative technologies in the cardiovascular space. We profile the firm to find out more and explore how it came to be awarded Most Innovative Medical Device Company 2017 – France in our prestigious 2017 Global Excellence Awards.

Established in 2010, FineHeart started with a vision of making a wirelessly powered, fully implantable, pulsatile circulatory support system that would overcome many of the challenges associated with left ventricular assist devices currently on market. It is a game changing therapy for long term circulatory assistance in severe heart failure patients.

Fundamentally, Heart Failure (HF) is the second leading cause of death in G20 countries. It is a degenerative disease with high mortality rates, repeated and extended hospitalizations. Critical HF with short life expectancy affects 13% of the total HF population every year. For a majority of them, there is no performing therapy. The current standard of care is medical therapy, until HF is advanced enough to warrant device-based intervention. Patients who have failed to respond to CRT pacing are evaluated for left ventricular assist device (LVAD) placement. Currently available LVADs are large, cause substantial myocardial damage, are subject to infection and thrombosis risk, and are therefore used in a small proportion of the HF population.

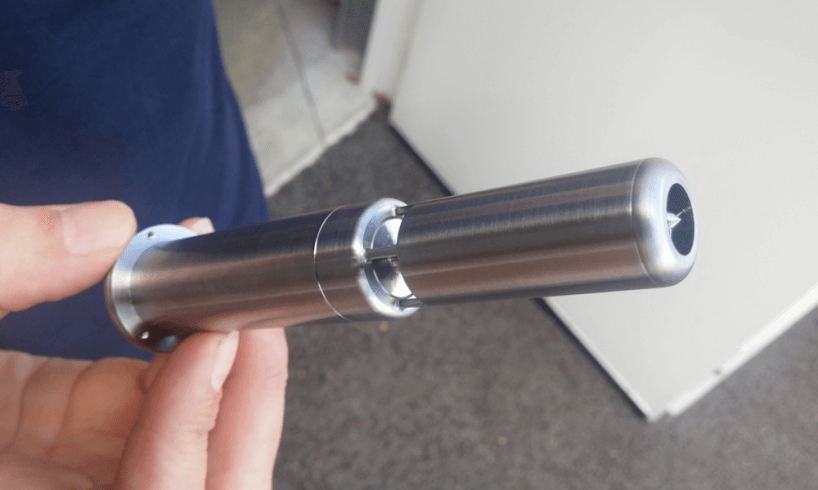

The patented FineHeart invention, the ICOMS, Implantable Cardiac Output Management System, is able to optimise cardiac output while preserving the heart’s innate contractility.

The ICOMS is a hybrid system between a pacemaker and a LVAD which powers a mini-propeller, pulsatile and synchronized to the heart activity. As opposed to traditional LVAD aspirating in a continuous flow the blood arriving to the ventricle, the ICOMS is the only device in which the motor is placed through the wall of the heart, and where the blood is accelerated into the heart at each beat.

This unique innovation would not be possible without a dedicated team of thought-leaders, all of whom are committed to creating truly ground-breaking technology. FineHeart was founded by a team of internationally renowned cardiologists and managers from the Medtech Industry, led by Arnaud Mascarell (CEO), Dr. Stéphane Garrigue (CSO) and Dr. Philippe Ritter, coinventor of cardiac resynchronization therapy.

To remain at the forefront of emerging developments in the market, this dedicated and talented team use a number of techniques including competitor surveys, technological updates, training, independent experts and consultants so that their technology would be always truly cutting edge and meet the ever-evolving needs of heart failure patients. The firm’s patient centred internal culture, ensures that every member of the team is constantly focused on the overall goal, and remains focused on creating solutions designed to support patients.

Ultimately, at FineHeart the overarching goal is to restore normal cardiac output and allow heart failure patients to return to a normal quality of life. To achieve this, going forward the firm will be seeking financing and/or strategic partnership to continue developing its ICOMS and start in the future clinical trials of its innovative therapy.

Company: FineHeart

Contact: Arnaud Mascarell

Contact Email: contact@fine-heart.com

Address: Hôpital Xavier Arnozan, Avenue du Haut Leveque, PESSAC, 33600, France

Phone: 00 33 5 57 10 28 90

Website: www.fine-heart.com