Discover The Latest Posts

Stay ahead in the corporate arena with our up-to-date articles that bring you the latest trends, analysis, and news. Whether it's a deep dive into emerging technologies or a critical look at evolving business models, our content is designed to keep you informed and ready to tackle today's most pressing corporate challenges.

Our articles cover a broad spectrum of topics—from strategic planning and leadership development to market trends and sustainability. Each post is designed to offer actionable insights and unique perspectives that are crucial for success in today's competitive business landscape. Dive in to enrich your knowledge and fuel your corporate journey.

Finance

FinanceIn today’s global economy, intangible assets such as intellectual property (IP), brand equity, proprietary technology and customer relationships are becoming critical components of corporate value.

News

NewsTariffs have always impacted business strategies. However, as new trade barriers intensify, companies must reexamine their operations and supply chains.

News

NewsArticle written by Alexandr Grygoryev, CEO at Andersen. Today, in the age of Industry 4.0 and the rapidly unfolding digital transformation, technology is at the core of business growth. It brings value to various aspects of business by enabling informed decisi

News

NewsIf you want to break away from outdated marketing methods and actually connect with your audience, artificial intelligence isn’t a luxury—it’s a requirement.

M&A

M&AColler Capital, the world’s largest dedicated private market secondaries manager, has announced a global distribution partnership with Allfunds.

News

NewsLeading UK technology consultancy identifies the key warning signs that your Target Operating Model isn’t working for you.

Corporate Social Responsibility

Corporate Social ResponsibilityDoing business across borders is no simple task. Companies must navigate a maze of labor laws, environmental standards and cultural expectations that often clash from one country to the next.

Corporate Social Responsibility

Corporate Social ResponsibilityAndrew King is the founder of SGT, a Buckinghamshire-based firm helping businesses across the UK find commercial energy tariffs that meet their needs while keeping costs low. Andrew explores how businesses can cut energy costs while also cutting down their car

Corporate Social Responsibility

Corporate Social ResponsibilityEnergy Drive srl was established in Milan in 2009, born out of the meeting of several like-minded men and women whose common ground was a relentless passion for protecting the environment and saving our planet.

Corporate Social Responsibility

Corporate Social ResponsibilityMarch 8th 2025 marks International Women's Day, and this year’s theme, Accelerate Action, calls for urgency in advancing gender equality.

Corporate Social Responsibility

Corporate Social ResponsibilityAs technology continues to evolve, so do the cyber threats that come with it. Cyber criminals are becoming ever more sophisticated and are finding new ways to exploit vulnerabilities and compromise systems.

Corporate Social Responsibility

Corporate Social ResponsibilityEkrem Akcay is a highly accomplished Mechanical Engineer with over 20 years of international experience in welding technologies, industrial automation, manufacturing, and energy efficiency across Turkey, the UK, Germany, Dubai, and the USA. He earned his Mecha

Finance

FinanceIn today’s global economy, intangible assets such as intellectual property (IP), brand equity, proprietary technology and customer relationships are becoming critical components of corporate value.

Finance

FinanceThe costs of starting and sustaining a small business can be daunting, but support is available to help you reap the rewards. So, what help is readily available when it comes to balancing energy costs?

Finance

FinancePrivate equity-driven M&A activity in the IFA sector surged in the UK in 2024, despite economic and regulatory headwinds, with strong valuations expected to sustain momentum into 2025.

Finance

FinancePioneering digital product studio, Format-3, has supported the raise over $100 million for tech start-ups over the last 2 years alone through its unique incubator model - innovation accelerator.

Finance

FinanceInternational tax compliance has become increasingly complex for today’s globally active companies. With operations crossing borders and tax authorities heightening enforcement, business professionals face growing pressure to ensure accurate and timely repor

Corporate Social Responsibility

Corporate Social ResponsibilityAndrew King is the founder of SGT, a Buckinghamshire-based firm helping businesses across the UK find commercial energy tariffs that meet their needs while keeping costs low. Andrew explores how businesses can cut energy costs while also cutting down their car

Innovation

InnovationThe meeting point between timeless education principles and next-generation learning, IVA Global School in South Africa is the first virtual 3D school in the world.

Innovation

InnovationWhen people say "innovation," most minds jump to technology—apps, AI, algorithms, and maybe something about blockchain.

Innovation

InnovationLove it or loathe it; business transformation now seems to be a regular, if not constant part of corporate life, as smart organisations adapt to economic shifts, new technologies and ever-evolving expectations from customers and staff.

Innovation

InnovationEkrem Akcay has worked for many years as Sales Manager and Project Leader in the Tuzla/Yalova shipyard region, which is home to most of the shipyards in Turkey and employs approximately 50,000 workers.

Innovation

InnovationAgentic artificial intelligence (AI) seems like an enterprise’s ideal. Most AI requires constant oversight and guidance, while agentic versions are autonomous and self-motivated.

Innovation

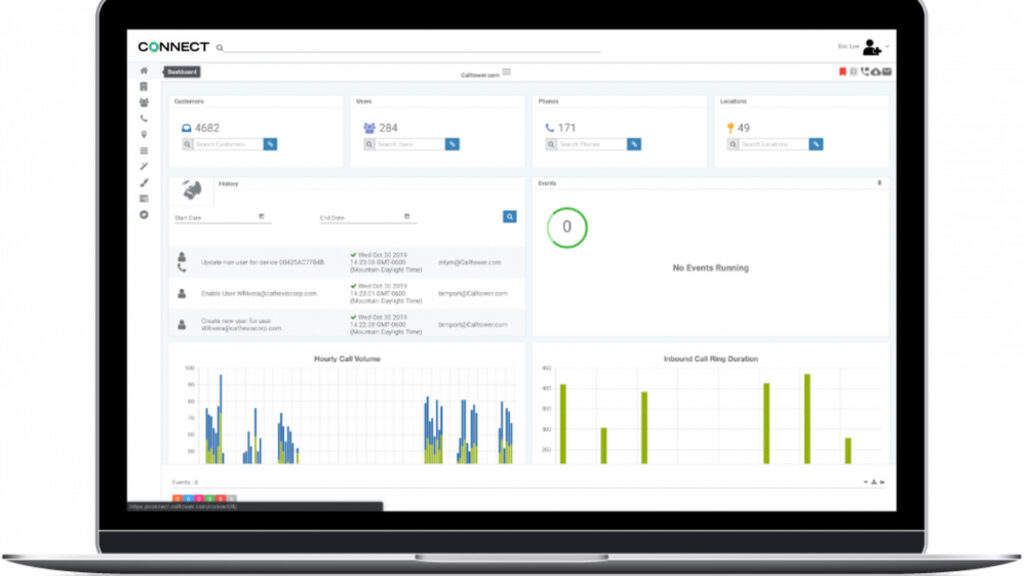

InnovationCallTower is a leading provider of cloud-based unified communications, contact centre, and collaboration solutions.

Leadership

LeadershipAlthough telework is generally beneficial, removing the face-to-face aspect from business-critical tasks has left some organizations vulnerable to work-from-home (WFH) scams. What are the latest schemes targeting remote workers, and what can employers do to he

Leadership

LeadershipVirtual reality (VR) could revolutionize learning in professional settings by turning tedious, unengaging training sessions into immersive, motivational experiences. What should business leaders know before they consider investing?

Leadership

LeadershipIn today’s fast-paced business environment, risk management has never been more critical, or more complex.

Corporate Social Responsibility

Corporate Social ResponsibilityNadine Hack - who’s held senior posts and/or served on governing and advisory boards in city, state and federal government, the United Nations, global nonprofits, and international companies - has been an Ethical Business Thought Leader since the 1960s.

Leadership

LeadershipMany company leaders envisage a clear distinction between the methods and skills needed to run a specific project and the day-to-day management of their firm.

Corporate Social Responsibility

Corporate Social ResponsibilityAt Huatan, sustainability meets innovation in every project. From creating breathtaking green spaces to pioneering the export of live Mexican plants to the U.S., Huatan redefines landscaping. Discover how this multi-award-winning company is transforming ordina

Finance

FinanceIn today’s global economy, intangible assets such as intellectual property (IP), brand equity, proprietary technology and customer relationships are becoming critical components of corporate value.

Legal

LegalWhile not every buyout or merger includes noncompetes, understanding how to approach these clauses can be critical to successful deal-making.

Legal

LegalPublic inquiries are independent investigations launched to address events of public concern. They are designed to examine large-scale failures arising from regulatory breakdowns, corporate misconduct, or systemic injustices, and to propose solutions to preven

Legal

LegalPublic inquiries are powerful tools in scrutinising business practices and often come with high stakes for the organisations involved.

Legal

LegalCompliance is complex, especially when there are regional differences and numerous country-specific regulations to consider.

Legal

LegalBackground checks are a standard part of the hiring process at many companies. While these verification procedures are often essential, they can also introduce some complications around privacy and ethics. The use of biometric authentication in this sphere fur

M&A

M&AColler Capital, the world’s largest dedicated private market secondaries manager, has announced a global distribution partnership with Allfunds.

Legal

LegalWhile not every buyout or merger includes noncompetes, understanding how to approach these clauses can be critical to successful deal-making.

Finance

FinancePrivate equity-driven M&A activity in the IFA sector surged in the UK in 2024, despite economic and regulatory headwinds, with strong valuations expected to sustain momentum into 2025.

Finance

FinanceIn any competitive marketplace there are lots of drivers for companies to merge and acquire each other. Sometimes it’s about expanding market reach by tapping into markets that a competitor has better footings in, or it could be about being better positioned

M&A

M&APanoram, a GenAI software specialist, announced its appointment by Peak Energy, an Asia Pacific focused renewable energy platform backed by Stonepeak, to enhance its merger and acquisition (M&A) due diligence.

Innovation

InnovationIn an ecommerce industry first, systems integrator, Ferag, and auto-boxing specialist, Sparck Technologies, have collaborated to develop a continuous ‘one touch’ process from order-picking to individual ‘fit-to-size’ boxes ready for despatch.

Finance

FinanceIn today’s global economy, intangible assets such as intellectual property (IP), brand equity, proprietary technology and customer relationships are becoming critical components of corporate value.

News

NewsTariffs have always impacted business strategies. However, as new trade barriers intensify, companies must reexamine their operations and supply chains.

News

NewsIf you want to break away from outdated marketing methods and actually connect with your audience, artificial intelligence isn’t a luxury—it’s a requirement.

M&A

M&AColler Capital, the world’s largest dedicated private market secondaries manager, has announced a global distribution partnership with Allfunds.

News

NewsLeading UK technology consultancy identifies the key warning signs that your Target Operating Model isn’t working for you.

News

NewsInterest in autonomous AI tools is accelerating, as businesses look to streamline operations and enhance customer experiences.

News

NewsIf you want to break away from outdated marketing methods and actually connect with your audience, artificial intelligence isn’t a luxury—it’s a requirement.

News

NewsInterest in autonomous AI tools is accelerating, as businesses look to streamline operations and enhance customer experiences.

News

NewsGlobal survey of more than 2,400 marketing and sales professionals reveals that while data dependency is growing, data competence lags, hindering productivity.

News

NewsIn today’s digital landscape, cyber threats have evolved from isolated IT concerns to critical business risks that can undermine a company’s competitiveness.

Leadership

LeadershipAlthough telework is generally beneficial, removing the face-to-face aspect from business-critical tasks has left some organizations vulnerable to work-from-home (WFH) scams. What are the latest schemes targeting remote workers, and what can employers do to he

Finance

FinancePioneering digital product studio, Format-3, has supported the raise over $100 million for tech start-ups over the last 2 years alone through its unique incubator model - innovation accelerator.

- More exposure for your business

- Create more brand trust and recognition

- More leads and opportunity

Acquisition International is a flagship brand of AI Global Media. AI Global Media is a B2B enterprise and are committed to creating engaging content allowing businesses to market their services to a larger global audience. We have a number of unique brands, each of which serves a specific industry or region. Each brand covers the latest news in its sector and publishes a digital magazine and newsletter which is read by a global audience.