Leading M&A Adviser for 2016

For Haitong International Securities Group Limited (“Haitong International”; 665.HK), mergers and acquisitions (M&A) is not only one of our key business segments, but the essence that makes us who we are.

Haitong International made its foray into Hong Kong market through acquisition of Taifook Securities Group in 2010, rendering it the first Chinese securities company to have successfully acquired a Hong Kong securities firm. The successful acquisition brought not only a SFC license, but also a huge client database as well as teams of experienced and licensed securities and futures intermediaries. This unprecedented expansion module has sparked a trend in the industry and many of our peers had followed suit.

Under our internationalisation strategy, Haitong International in 2015 made its second M&A adventure by taking over Japaninvest, a UK-based independent equities research institute. With our high execution power, we have established a new business unit – Cash Equities – building on the foundation of equities research, sales trading and research sales functions in six months as part of business consolidation after the acquisition. The takeover helps further expand our business spots from Hong Kong to other major global financial hubs including New York, London, Tokyo and Singapore. Through these two significant acquisitions and rapid development of different business units, Haitong International has transformed itself from a local securities company to one of leading market players with global footprint. Haitong International topped the ranking among Hong Kong-listed Chinese securities companies in terms of total assets, net assets, total revenue and net income as of end 2015.

To date, Haitong International is an international financial institution with established presence in Hong Kong and a rapidly expanding network across the globe. It strives to serve as a bridge linking up the Chinese and overseas capital markets. Haitong International is a subsidiary of Haitong International Holdings Limited, a company incorporated in Hong Kong and wholly owned by Haitong Securities Co., Ltd. (“Haitong Securities”, 600837.SH; 6837.HK). Haitong International is well positioned to serve over 190,000 corporates, institutional and retail clients worldwide. Its well-established investment banking business platform provides corporate finance, brokerage and margin financing, asset management, fixed income, currency and commodities (FICC), leveraged and acquisition finance, equity derivatives and a full spectrum of financial products and services.

In a broader view, under the “Go Out” and “One Belt One Road” policy of Chinese central government,in addition to the industry consolidation worldwide spurred by globalisation, it is expected that Chinese corporates will continuously seek overseas expansion opportunities, and their acquisition activities will probably enter a new era. It is believed that the focus of their acquisitions will be focusing on new technologies such as alternative energy, information technology and green economy, echoing the central government’s advocacy of new economic growth initiatives.

Meanwhile, acquiring the so-called “Soft Power” such as management skills probably would also be one of the considerations when they hunt for their targets. Haitong International – a Pioneer in M&A In order to ride on the new wave of business opportunities in global M&A, we have recently beefed up our Leveraged and Acquisition Finance Department (LAF) with a clearer market positioning focusing on providing corporate clients with a full array of acquisition consultation, bridge financing and project distribution services. Acquisition consultation services include the engineering of acquisition proposal, financing consultation, valuation of target firm, capital structure planning and business negotiation, and so on.

Financing services involve the flexible use of the capital market to provide clients with the most suitable financing solutions. In order to better leverage the asset profile of Haitong International and participate in more top-tier projects, LAF has been actively developing project distribution services, sharing in the forms of convertible bonds, priority debts, structured notes and equity derivatives with investors or other financial institutions.

The projects of LAF can be roughly divided into 3 categories: 1) To assist Chinese corporates to delist from foreign exchange markets and return to the A-share market in order to realise the potential valuation difference; 2) To facilitate local corporates’ overseas acquisition and vice versa and; 3) To offer proposals and financing solutions to Hong Kong-listed companies in relation to, among others, the acquisition of controlling stake, increase in shareholding by major shareholders, rights issue and placing of shares. “Our in-depth understanding of the clients’ business and needs, our unique experience and skill-sets in the M&A business, as well as our strong China background and international outreach – are all keys to the success of our clients’ M&A transactions,” said Luke Cheung, head of M&A business of Haitong International.

In 2015, Haitong International actively took part in a number of sizable acquisition projects by offering clients with various bespoke financing solutions. Within the year, deals that we actively participated exceeded 20 in number and reached HK$10 billion in value. For instance, Haitong International participated in providing financing the privatisation of China Cord Blood Corporation (CO.US).

It also advised and financed China’s Southwest Securities Co. Ltd.’s HK$700m (US$90m) Financial Holdings Ltd. (now renamed as Southwest Securities International Securities Ltd. (0812.HK)) in 2014. Haitong International also financed and advised a great number of rights issue and general offer transactions, and is adept at using a broad spectrum financial instruments to facilitate the M&A transactions of its clients.

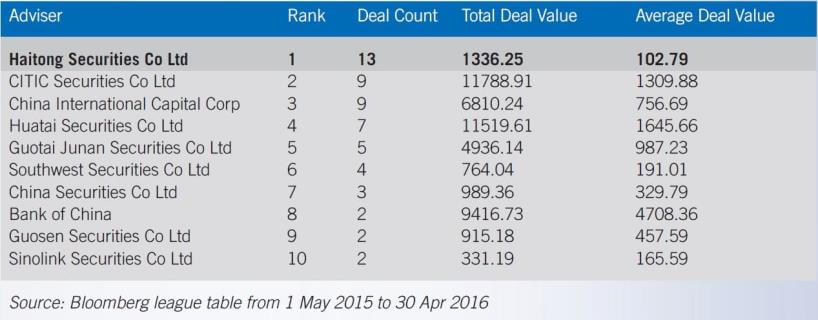

Strong momentum prevails in our M&A business in 2016. According to Bloomberg league table, Haitong International ranked no.1 in terms of number of M&A deal filtered by Hong Kong region among all Chinese securities houses in the past year ended 30 April 2016. (Please see below table).

To make itself a competitive player in the market, Haitong International’s LAF department currently comprises 21 team members with different backgrounds and most of them have experiences in foreign investment banks, commercial banks and fund houses. All of them are elites in the field with high proficiency in Cantonese, Mandarin and English, professional industry knowledge and extensive experiences in corporate acquisition, overseas acquisition, reverse takeover and VIE integration. All of them are proactively seeking acquisition targets across the globe for local and overseas clients, striking to provide effective and premium acquisition services.

Company: Haitong International

Securities Group Limited

Email: ir@htisec.com

Web: http://www.htisec.com

Address: 22/F Li Po Chun

Chambers, 189 Des Voeux Road

Central, Hong Kong

Phone: 852 2213-8678