The prop trading industry has expanded rapidly in recent years, offering traders structured access to significant capital without requiring large personal deposits. Among newer firms, gaining strong traction is OneFunded — positioned as one of the fastest-growing prop firms in the market.

This review explains what prop trading is, how OneFunded operates, its challenge models, trading rules, payouts, and what differentiates it structurally from many competitors.

What Is Prop Trading?

Prop trading is a model where traders operate funded accounts provided by a firm instead of risking their own capital.

The process typically works in three stages:

- The trader purchases an evaluation challenge.

- The trader must hit predefined profit targets while respecting strict drawdown limits.

- After successful completion, the trader receives access to a funded account and earns a percentage of generated profits.

The key idea behind prop trading is risk control. The firm defines maximum daily loss, overall drawdown, and trading rules in advance. Capital scaling depends on performance, not personal net worth.

OneFunded follows this structured approach but removes one common industry pressure point: time limits. There are no deadlines on any evaluation phase.

Overview of OneFunded

OneFunded provides virtual funded accounts ranging from $2,000 to $200,000 across multiple evaluation formats. The platform offers clear rules, fair evaluations, and professional tools to support consistent performance and growth.

Core Specifications:

- Account Sizes: $2K – $200K

- Platforms: cTrader & TradeLocker

- Markets: Forex, crypto, indices, metals, US & EU stocks

- Evaluation Types: 1-Step & 2-Step

- Trading Period: Unlimited

- Profit Split: 80% standard, scalable up to 90%

- Transparent Rules – No hidden terms, all rules clear from the start.

- Low Entry Cost – Start trading from just $16.

- Overnight Trading – Allowed; swap/rollover fees may apply.

- News Trading – Allowed, but trades around high-impact news are monitored.

- Copy Trading – Allowed across your own accounts to replicate strategies.

- Expert Advisors (EAs) – Pre-approved EAs can be used on OneFunded accounts.

The company emphasizes rule transparency and measurable performance metrics. All targets, limits, and payout conditions are published upfront.

As one of the fastest-growing prop firms in the sector, OneFunded has expanded its plan variety and technology integration quickly while keeping evaluation structures consistent.

Types of Challenges

OneFunded offers four structured evaluation models.

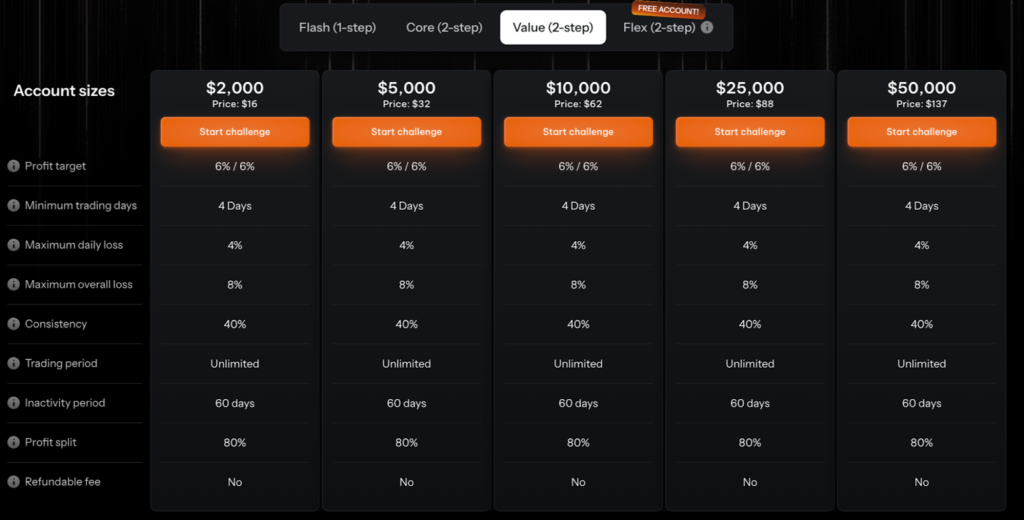

1. Value – Disciplined & Affordable (2-Step)

Designed for traders who prefer structured targets and lower entry costs.

- Profit Target: 6% / 6%

- Daily Loss: 4%

- Overall Loss: 8%

- Consistency Rule: 35%

- Minimum Trading Days: 4 per phase

- Refundable Fee: No

- Entry Price: From $16

- Max Size: $50K

Best suited for disciplined traders comfortable with tighter drawdown parameters.

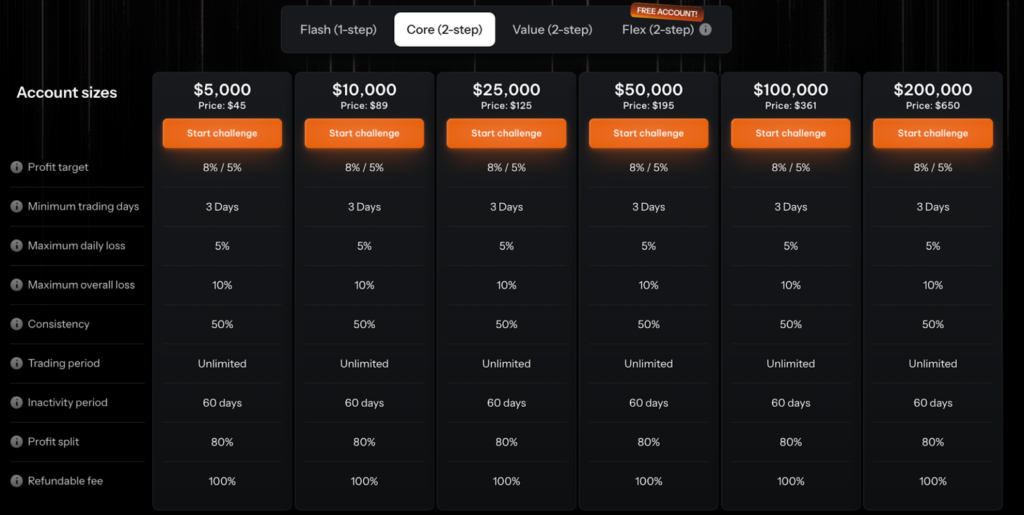

2. Core – Balanced Classic Model (2-Step)

The most popular plan with refundable fee structure.

- Profit Target: 8% (Phase 1) / 5% (Phase 2)

- Daily Loss: 5%

- Overall Loss: 10%

- Consistency Rule: 50%

- Minimum Trading Days: 3 per phase

- Refundable Fee: 100% after success

- Entry Price: From $45

- Max Size: $200K

This model balances flexibility and structured risk control.

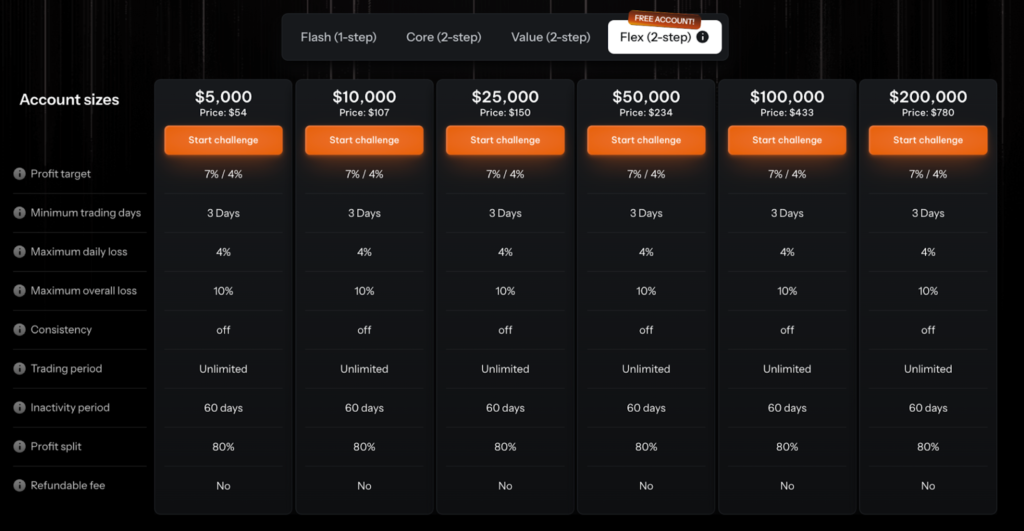

3. Flex – Premium Flexibility (2-Step)

Built for active traders who prefer fewer constraints.

- Profit Target: 7% / 4%

- Daily Loss: 4%

- Overall Loss: 10%

- Consistency Rule: None

- Minimum Trading Days: 3 per phase

- Refundable Fee: No (free challenge instead)

- Entry Price: From $107

- Max Size: $200K

Flex removes the consistency rule, allowing variable daily performance without structural penalties.

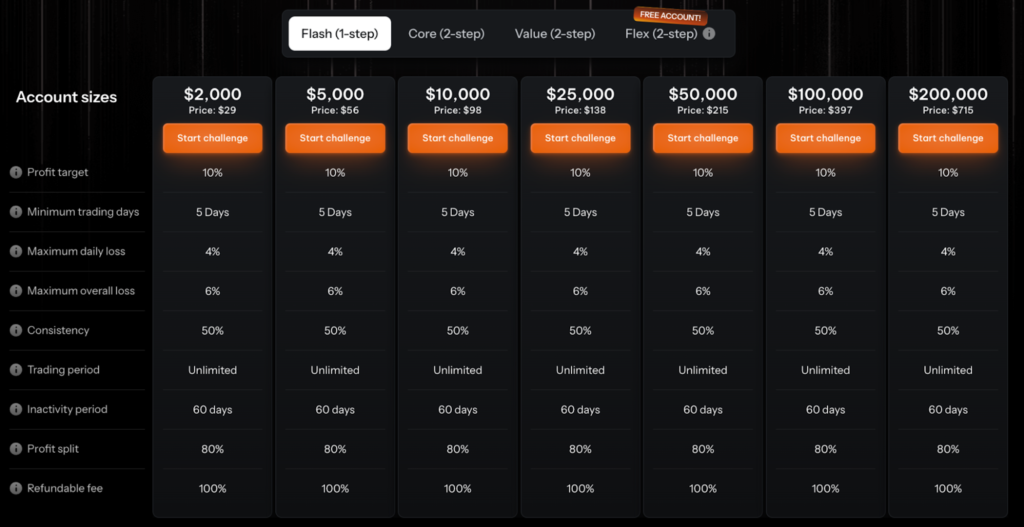

4. Flash – Fast 1-Step Funding

Single-phase evaluation for traders seeking quicker progression.

- Profit Target: 10%

- Daily Loss: 4%

- Overall Loss: 6%

- Consistency Rule: 35%

- Minimum Trading Days: 5

- Refundable Fee: Yes

- Entry Price: From $29

- Max Size: $200K

Flash offers the shortest route to funding.

Trading Environment

OneFunded integrates:

- cTrader

- TradeLocker

Both platforms provide institutional-grade execution, advanced charting tools, and detailed analytics.

Permitted Trading Styles:

- Overnight trading (swap/rollover fees may apply)

- News trading (monitored around high-impact releases)

- Copy trading between personal accounts

- Pre-approved Expert Advisors

There are no forced weekend closures and no hidden execution restrictions.

Payout Structure

- Profit Split: 80% standard, scalable to 90%

- First Withdrawal: 14 days after first trade

- Recurring Withdrawals: Every 14 days

- Weekly Option: Available as add-on

- Minimum Withdrawal: $100

- Methods: Crypto (USDT TRC20) & Bank Transfer

Core and Flash plans refund evaluation fees after successful completion. Flex provides a free challenge instead.

Additional Features

- Rewards Center – Traders earn points by completing platform activities. Points can be redeemed for discounts or free challenges.

- Educational Blog – OneFunded maintains a structured blog covering trading psychology, risk management, and platform tutorials.

- Affiliate Program – Partners can earn commissions by referring new traders.

Why OneFunded Stands Out

The prop trading space is competitive, but growth typically comes from clarity and reliability rather than marketing claims.

OneFunded differentiates itself through:

- No time limits

- Clearly defined drawdown rules

- Multiple challenge formats

- Scalable profit split

- Rapid product expansion

- Transparent payout schedule

Its rapid expansion and structured infrastructure position it among the fastest-growing prop firms currently operating.

Final Verdict

OneFunded provides a rule-driven, clearly structured prop trading environment suitable for different trader profiles — from disciplined swing traders to high-frequency scalpers.

The absence of deadlines reduces psychological pressure. Transparent metrics simplify risk management. Multiple funding models allow traders to choose structure over hype.

For traders seeking measurable evaluation criteria, scalable profit potential, and a modern trading infrastructure, OneFunded represents a structured and rapidly expanding prop trading solution.