Buying an expensive item abroad may not sound like a logical go-to in the wake – or the midst, depending on your position – of a global pandemic. Supply chains have been chewed up, with worker and truck driver shortages, along with a microprocessor shortage that has affected a surprisingly wide range of industries.

Nevertheless, we are more likely to purchase something from abroad than ever before. The reason for this is in part because of the pandemic, in which it shifted those who were tech reluctant to actually head online and shop – with this being the only option in some cases. We can see this reflected in the soaring share price of couriers like UPS over the past couple of years.

The fact is that, when buying online, we don’t always know immediately where we’re buying from. This highlights how frictionless and borderless our economy is becoming, but there’s an issue. When paying for our goods, we are used to using our debits and credit cards. This is fine domestically, but when buying a large item from abroad, you’re likely to land yourself with a lot of FX bank fees for an international transfer.

For example, HSBC is arguably the largest bank in England and it charges 2.99% (if you can find it in the small print) in non-Sterling transaction fees for purchases, not to mention the same fee for non-Sterling withdrawals. If you wanted to avoid the card payment and instead send large amounts of money abroad via bank transfer, you’re looking at more than 3% markup (closer to 5% in US and Australia) in conjunction with wire fees – thus rendering the payment too expensive, in many instances.

Issues also arise with some international purchases when it comes to regulation. There can be limits placed on a card, and some deals can be flagged by the issuer which then requires jumping through several hoops in an attempt to resolve. As we can see, mainstream banking payment solutions are not keeping up with the digitized, globalized economy.

Is PayPal the answer?

PayPal, being a tech company whose sole focus is on online transactions, is somehow just as expensive as highstreet banks using legacy systems. Beyond the usual seller fees that they charge to facilitate business transactions, there are cross-border fees alongside FX conversion fees that can quickly amount to 5%.

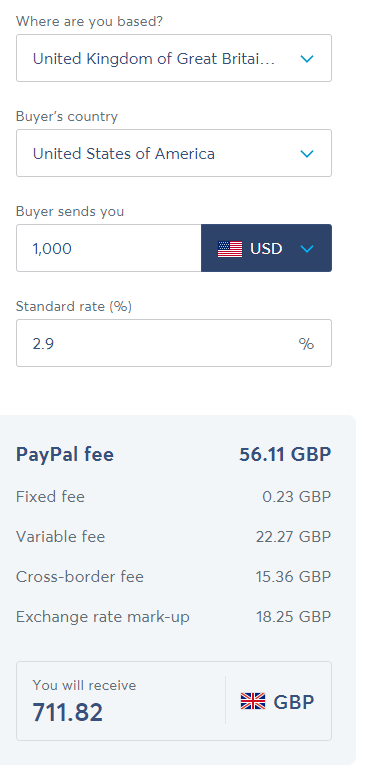

A simple, common payment route where a Brit buys an American product in USD will amount to over 6% in PayPal fees, according to the Wise PayPal calculator. A $1,000 USD payment will amount to (when this article was created):

For further context, $1,000 is supposed to result in £767.54, not £711.82. Clearly, PayPal is not the answer and for a large payment abroad, you’re going to get stung.

Is Cryptocurrency the answer?

A natural reaction to this problem of friction and inefficiency is to think of crypto because that’s what we often hear as being its key value proposition “fast, secure, cheap transactions of money”. To transfer a large sum of money abroad to another wallet overseas may be free, but there’s more going on.

There are three key issues here, though. Firstly, most companies are still yet to accept crypto as payment, although this trend is growing. It can be frustrating to see an item that you want to buy not accepting crypto as payment, and even if many are, we still need to figure out an alternative for these situations.

The second issue is that, whilst the transaction itself is frictionless, buying and selling crypto with fiat on an exchange is far from frictionless. The spread for crypto on Coinbase, for example, is around 0.5% – not bad at all. However, they also impose fees. For US users, there is a fixed fee of $0.99 for transactions under $10 – a ridiculous 10%+. This decreases in proportion, with a $2.99 fee for transactions between $50 and $200. On top of this, there is a withdrawal fee at many CEXs, though Coinbase doesn’t include a fee here for ACH transfers (it’s 2.49% for debit/credit cards.)

We are clearly getting to high-street bank levels of fees here. Of course, it’s possible to cut down on some of these by using other exchanges, but it’s important to use Coinbase because it’s the second-largest crypto exchange in the world. The reason for this is that it’s so simple to use, which is necessary for some who find crypto confusing. Binance, for example, is slightly cheaper, but it’s infinitely more confusing to use, which would only introduce another issue.

Finally, the most obvious issue is that holding crypto can mean being at risk of its ruthless volatility. As it stands, holding crypto for someone who isn’t interested in high-risk assets is a no-go. Thus, we’re in a situation where you have to exchange from fiat to crypto each time you want to purchase, making it less convenient and being hit with deposit/transaction fees more often.

Money Transfer Companies – The best way to send funds

You may be losing hope here, but money transfer companies may be offering the perfect solution to all of these problems. Money transfer companies, which are companies like Wise, Revolut, and Torfx which you may have heard of, are a little bit more FX-focused.

We may think this is different from PayPal, but actually, PayPal’s key value proposition was always networking and safety – it was easy to bring up refunds and such with them, making them ideal for selling on eBay.

However, money transfer companies are even more stripped back, although different companies have different approaches. Whilst they all use state-of-the-art infrastructure for these cross-border payments, some will focus on being the perfect method for large sums, along with offering free FX guidance, whilst others take a more day-to-day spending approach.

In the example of a company suited to large sums, like Currencies Direct, this will be the ideal way to purchase a home overseas, for example. Not only do the fees + spread amount to under 1%, but there will be a dedicated dealer that can provide free guidance and support over the phone. They’re not there to hassle you, but be a free dealer, and can often recommend and support in other areas too, such as business and investment.

Regardless of what company you pick (many use multiple companies because they’re easy to sign up to), they will likely be using a mixture of infrastructures and focus on low transaction fees – because this is the most important thing to the customer. As a result, 0.5% to 1% has become an industry norm – though Revolut has taken their competitiveness to the extreme, offering literally zero fees or spreads for many currency pairs, but will instead have a monthly transfer limit that can be lifted in their freemium model.

The beauty of money transfer companies is not just cheap transfers but the multi-currency wallet. Taking a second to open up the app (no more outdated apps created by 300-year old banks), and an extra couple of seconds to open virtual accounts in any supported currency.

This means that not only will the “virtual” card details, that behave like a bank, can facilitate overseas payments, but you will have banking details for each and every currency account – meaning parties from that country can send you money for free. You receive the funds in their currency, as a seller for example, which avoids the conversion and cross-border fees.

Not only does this give the user the choice of when to convert – or juggle their money into different currencies as and when they want to (conversions take seconds), but the conversion itself is likely to be sub 1% in fees and spread combined.