Choosing the right funding solution can feel overwhelming. Whether starting a new business or expanding an existing one, knowing about no-money-down options and what other funding methods are available can dramatically simplify your approach. This guide doesn’t just explore traditional means like loans and investors but also covers modern financial technologies such as cryptocurrency investment platforms.

Understanding Different Funding Avenues

Businesses require funding from various sources, with traditional means like bank loans or lines of credit being common. However, alternatives like crowdfunding, angel investors, or venture capital provide a mix of opportunities and challenges. Furthermore, the rise of digital platforms introduces innovative funding methods. Platforms like Mobycap, for example, enable businesses to tap into emerging markets such as cryptocurrency, providing unique investment opportunities outside conventional financial systems.

Beyond these options, businesses can also look into government grants and subsidies designed to support entrepreneurship and innovation. These programs often target specific industries or business types, such as green technology or women-owned enterprises. While the application process may be competitive, securing a grant can provide a significant boost to your business without the need for repayment.

Matching Your Funding Type to Your Business Needs

Evaluating your business stage and requirements is vital when choosing your funding source. Start-ups may benefit from angel investors who provide not only capital but also guidance, whereas established businesses might prefer traditional loans. Additionally, digital funding solutions appeal to those looking to leverage technology with minimal initial investment. This approach offers flexibility and broad investment access.

It’s essential to consider the long-term implications of each funding type. Some options, like venture capital, may require giving up a portion of your company’s ownership and control. Others, such as loans, will need to be repaid with interest, impacting your cash flow. Carefully weigh the pros and cons of each option and consider seeking advice from financial experts or mentors in your industry.

Mergers as a Strategic Alternative for Growth

Mergers and acquisitions offer another avenue for funding. These methods not only bolster finances but can also expand into new markets and improve efficiency. Pursuing a merger requires understanding legal implications and finding strategically aligned partners. A successful merger depends on choosing partners who share your business vision, enabling smoother integration and growth.

Before pursuing a merger, it’s crucial to conduct thorough due diligence. This process involves assessing the financial health, legal standing, and operational compatibility of potential partners. Engaging the services of legal and financial advisors can help navigate the complexities of a merger and ensure that the deal aligns with your business objectives.

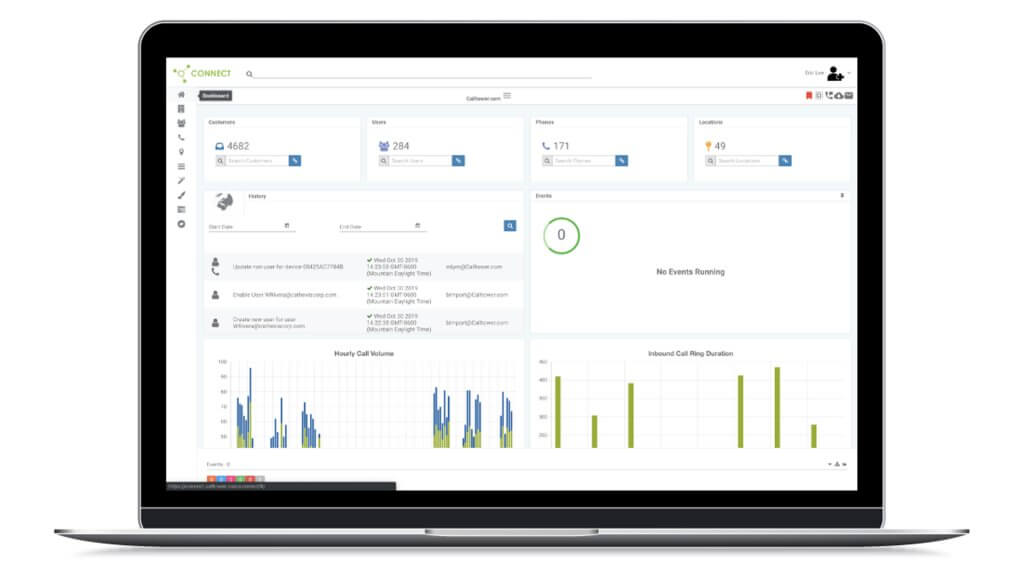

Technology: A Gateway to Accessible Funding

Technology significantly impacts funding access. Financial platforms use big data to create customized funding options tailored specifically to meet business needs. This forward-thinking strategy lowers entry barriers for small businesses and democratizes investments. Embracing platforms that support cryptocurrencies propels businesses towards a more flexible, global financial landscape.

In addition to cryptocurrency platforms, businesses can also leverage crowdfunding websites to raise capital. These platforms allow entrepreneurs to pitch their ideas directly to a large audience of potential investors. Successful crowdfunding campaigns not only provide financial support but also help validate market demand and build a loyal customer base.

Perfecting Your Pitch to Investors

When seeking funding, your pitch to potential investors is critical. It should highlight what sets your business apart, its profit potential, and how it meets market demands. Investors look for confidence and clarity. Presenting a well-supported argument for your business’s profitability and growth potential makes your pitch compelling. Being prepared to address potential investor queries can turn your presentation into an engaging narrative that aligns with their expectations.

Finding the right funding for your business involves understanding both traditional and new forms of financial support. From strategic mergers to innovative platforms like cryptocurrencies, the objective is to secure stable financial backing that supports sustainable growth.