Leading Advisors of the Year – Property Investment Advisor of the Year – UK award winner Intercorp Group is a privately owned high-level consulting firm, which provides tax, estate planning and fiduciary structure solutions to high-net-worth families. To celebrate their success, we invited them to profile a choice selection of the marvellous services they provide.

Intercorp Group functions as an accessible interface, streamlining intelligence from an elite global network of professionals and specialists and ultimately bestowing on clients both the knowledge, confidence and solutions to handle their matters in the best possible way.

Our services include: International investment structuring A primary concern of high-net-worth families is ensuring their wealth is sustainable, protected both now and for future generations. As a result, many families have long mobilised their assets internationally, safeguarding them against political, economic or social instability.

Intercorp’s consultants have at their disposal a number of investment vehicles and structures, each of which can have a positive impact upon the tax liability of the investments they support. At the heart of this is a tax efficiency programme, which employs our comprehensive knowledge of jurisdictional rules to identify the best opportunities for return.

While our consultants will never offer recommendations on the suitability of individual investments, the team is accomplished at advising the client’s fund managers on the best type of investment vehicles, always in full appreciation of tax legislation and the objective of the investment.

We are committed to keeping abreast of developments in these areas and regularly appraise and update our advice in line with such developments.

Protection of family businesses abroad Expanding the family company into other territories and the necessary safeguarding of both its intellectual property and its potential for multijurisdictional wealth generation.

As a natural consequence of family members moving abroad, many family businesses are expanding into other territories, bringing forth a plethora of considerations regarding the protection of the business. In terms of intellectual property, while clients will have taken care of the processes required to register and protect their brand under domestic legislation, this protection often will not survive under another jurisdiction. As the business expands, both the brand identity and the fundamental concept – the processes or products it trades on – are vulnerable to exploitation by competitors.

Intercorp Group ensures the effective preservation and development of brands and intellectual property across several jurisdictions, working with each business to define and integrate the value of their brand and their idea into legally recognised assets of the company. Our team can then execute the necessary registration of these assets through trademarks, patents, designs and copyright in each country of operation.

In addition, Intercorp Group regularly advises on the tax implications of cross-border expansion, identifying and mitigating issues surrounding the current business relationships and educating clients on solutions yielded through the formation of offshore holding companies.

Our consultants will engage with our global network of professionals to draw upon expertise spanning corporate and commercial contracts, intellectual property, data protection, tax, banking and finance, employment and immigration, ultimately acting as trusted advisor for the client, throughout the entirety of the process.

Asset protection In making new investments internationally and outside of the family business, the potential liability for risk, naturally increases. Intercorp works alongside both the families and their existing advisors to identify ways in which to minimise such risks.

“Ultimately, Intercorp Group professionals work to help clients reconcile the consequences of different structures

for their real estate investment and decide on a bespoke solution.”

Our consultants will assess and properly protect the invested assets and effectively structure the business to ensure the risks fall directly and solely on the capital to be invested. Our global perspective is particularly valuable for these types of engagements, as we ensure that any structuring undertaken is enforceable and reliable across all territories.

Corporate restructuring Preparing for a sale, merger, acquisition or initial public offering of the family company; the strategic counsel required to design and implement purchase and sale structures; cross-border tax implication and pre-transaction due.

Many family businesses reach a point of maturity, which demands the anticipation of a change in structure. This commonly manifests as either: an initial public offering (IPO); a private investment; or a merger or sale, each of these requiring exceptional skill, sensitivity and precision in their execution.

Intercorp Group regularly provides counsel on such matters, working collaboratively with existing advisors and our trusted network of professionals. Our consultants perform a pre-due diligence investigation on the clients’ business, highlighting potential complications that could affect the proposed restructuring and the company’s corporate attractiveness to other parties. This diagnostics report is a strategic and consolidated representation of the very best advice and clear identification of the courses of action required for their implementation.

Intercorp will then advise on the appropriate structures for the transaction, paying special regard to both cross-border tax liabilities and the potential implications of these on the family’s overall wealth, following the completion of the transaction.

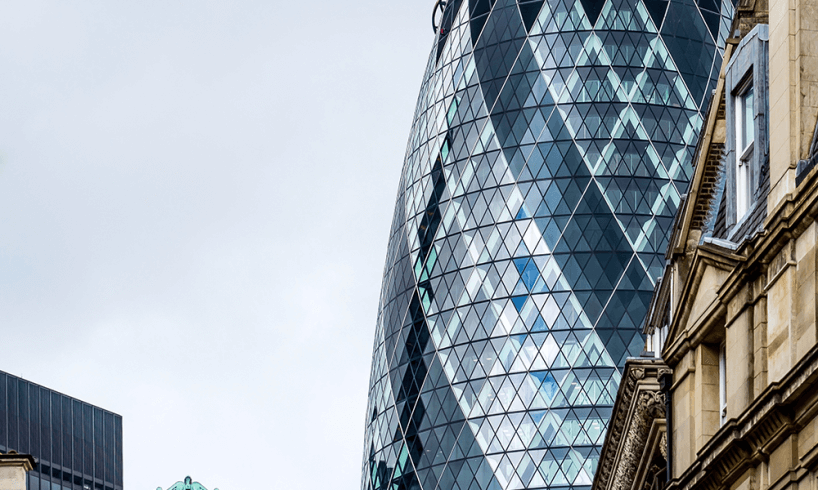

Real estate investment

Investing in property in other territories; the requirements to consider and mitigate estate tax obligations in both domicile and destination jurisdictions.

Investment in real estate is a very natural endeavour for high-net-worth families who are in pursuit of more tangible ways to invest their wealth. Particularly popular, is foreign investment in the US and UK real estate markets which each raise several estate tax liability issues. These in turn, must be mitigated to achieve the families’ investment objectives.

Intercorp Group manages the acquisition and financing processes in collaboration with our network of legal and commercial professionals across the world. Our advice always pays due regard to the individual needs of the family as well as the tax implications imposed both by their domestic jurisdiction as well as those of the country in which they wish to invest. Ultimately, Intercorp Group professionals work to help clients reconcile the consequences of different structures for their real estate investment and decide on a bespoke solution.