2016’s Most Innovative Hedge Fund Manager, Singapore

APS Asset Management was founded in 1995 by its CIO, Wong Kok Hoi, in Singapore. In what started as a pioneer among home-grown boutiques, the firm has continued to go from strength to strength. APS began with assets under management (AUM) of just US$15 mn, one office and seven staff and has now expanded to AUM of US$3 bn, 63 staff and six offices worldwide serving global pensions, endowments, family offices, sovereign wealth funds, financial institutions and other institutional asset owners as well as highnetworth individuals .What are the secrets behind their success?

Consistency is the key enabler at APS. By adhering steadfastly to key investment principles and steadily investing in non-investment areas of the business for more than 20 years, APS has been able to develop excellence and expertise which have enabled us to deliver superior returns to our clients.

Our original investment ideas are generated from several approaches: First, we do not view price volatility as risk. Instead, we define risk as valuation risk, business franchise risk, financial risk and people risk. Second, our team of more than 30 analysts and portfolio managers conduct investigative research on investee companies to get a firm grasp of the various risks mentioned above. We talk to the company’s competitors, suppliers, former employees, current employees, management and industry specialists. We construct our own cash flow models and forecasts.

Third, we take a long-term view and are never swayed by short-term noise in the market and sellside agendas. We have clear buy and sell disciplines to which we adhere consistently. We sell when valuation runs ahead of fundamentals or when our initial assumptions are proven wrong, and buy when valuation is low relative to fundamentals. Fourth, we constantly test our investment theses and change them where warranted by the facts. This has been our investment approach since day one and it has seen APS through multiple market cycles, booms and busts. We can’t say we’ve perfected the art and science of investing, though, and continual learning and improvement are part of our process.

Our investing approach has enabled us to spot opportunities and risks before the vast majority do. For example, we increased our exposure to Indonesia in 4Q2015 when it became clear that President Joko Widodo’s reforms are gaining ground; in light of an improved investment climate, several stocks we’ve thoroughly researched were undervalued. We shorted a Chinese e-commerce company that is the most crowded long among global hedge funds despite not making any profit after 12 years in business, taking significant equity-investment impairments, and not having a viable profit-making strategy. We invested into Venustech Group, an innovative and wellmanaged cybersecurity company in China, before internet security became a hot topic.

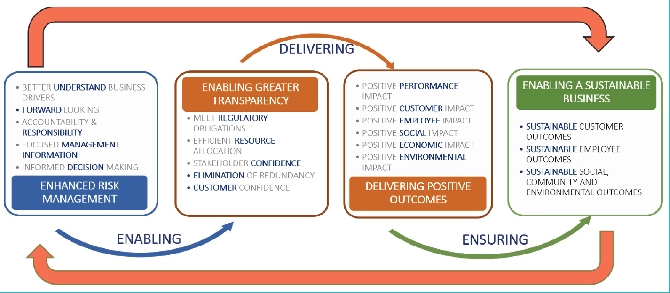

APS’ non-investment functions are equally important and we have fully staffed teams for compliance, risk management, equity trading, investment administration, client services, sales and marketing and other corporate functions. We place utmost importance on clients’ needs and our client servicing team is tasked with responding to all client queries within one business day.

Our investment success has been recognized by global organizations over the years. They include “Top-Performing Hedge Fund in 2015: APS Greater China Long Short Fund” by 2016 Preqin Global Hedge Fund Report; “Most Consistent Asian L/S Fund: APS Asia Pacific Long Short Fund” by AI Hedge Fund 2016 Awards; “Best Singapore-Based Hedge Fund: APS Asia Pacific Long Short Fund” by the Eurekahedge Asian Hedge Fund Awards 2016; among others.

APS Asset Management Pte Ltd

Email: cs@aps.com.sg

Web: www.aps.com.sg

Address: 3 Anson Rd,

#23-01 Springleaf Tower,

Singapore 079909

Telephone: 6303 4595