The Islamic Corporation for the Development of the Private Sector (ICD) is the private sector arm of the Islamic Development Bank (IDB), the world’s largest Sharia’a compliant multilateral institution. A spokesperson from the firm reveals more about the firm’s advisory services to governments, public entities and private entities of member countries to create the ideal environment to facilitate private sector investment.

First of all, can you tell us about what your company does? ICD focusses on supporting the development of our 57-member countries by stimulating the private sector in various ways. Our mandate is similar to other multilateral institutions with the proviso that all of our operations must be Sharia’a compliant. Apart from providing critical capital, we also impart knowledge, help manage risks and catalyse the required participation of others in order to achieve sustainable development goals.

Through ICD’s numerous projects, we support the type of entrepreneurial initiatives that help developing countries attain sustainable economic growth. Currently, we are rated ‘AA/ FQ’ by Fitch, ‘Aa3/P-1’ by Moody’s, and ‘A+ by Standard & Poor’s.

What kind of clients do you serve and how do you approach them? ICD provide advisory services to governments, public entities and private entities of member countries with an aim to create the ideal environment to facilitate private sector investment and to assist companies in unlocking their potential. Advisory services include project finance advisory, raising funds through the issuance of Sukuk, and encouraging the development of the business environment for SMEs. In the last couple of years, ICD has comforted its presence in the member countries with its advisory services, which complements its products through advising clients in issuing Sukuk and establishing Islamic financial windows and Institutions.

From lawyers, accountants, bankers and consultants to HR professionals, IT specialists and security experts, myriad outside agencies and organisations, to what extent do you think that such advisers contribute massively to a firm’s success? As a multilateral institution, we work with all our member countries. Some of them do have similarities and some have a unique market that needs to be dealt with, taking into consideration its particularity and uniqueness. ICD is mostly relaying in its internal resources, which consist of highly qualified professionals, but we do realise that for some projects, local or international expertise might be required. All the external parties are carefully selected so that both, ICD and the member country, can benefit from their inputs.

What role do staff play in the success of your firm? ICD’s business focus is the development of innovative, high-quality products and services – employee performance plays an integral role in achieving our business goals – and we realise that all steps of ICD’s products from conception to marketing are essential components. Employee performance in these areas is therefore critical to our business success.

Due to that, ICD invests in each and every employee, who, in turn, contribute to the success of ICD. We work in an inclusive environment that embraces change, new ideas, respect for the individual and an equal opportunity for them all to succeed

Do you have any plans for the future that you would like to share with our readers? Since its inception, ICD has devoted itself to private sector development in its 57-member countries to promote inclusive growth and poverty reduction. It has addressed some of the major constraints for the private enterprises including providing access to capital and advisory services to improve financial practices and channels to maximise development impact, with efforts specifically geared towards promoting Islamic finance. Some of our results for 2016 include the creation of over 50,000 jobs in our member countries.

We also generated $65.4mln in increased government revenues, and contributed $11.8mln to community development initiatives including: • Providing new energy sources for 2 million people and; • Supporting 1,180 small- and medium- enterprises and 3,944 new businesses, including 1,794 housing projects and 61 agribusiness projects.

Moving forward, we will continuously strive to increase private sector engagement in our member countries. In this regard, ICD has set a 10-Year Strategic RoadMap, supported by a 4-Pillar strategy that consists of: 1. Developing Islamic finance channels; 2. Investing in high-impact sectors; 3. Improving the enabling environment and; 4. Mobilising resources.

Do you have any further comments to make? ICD has been on a transformational journey since its establishment 16 years ago. Starting with a limited number of products, services and countries of operation, ICD has gradually become the Islamic private sector development institution of reference. ICD operational evolution has taken on a very holistic trend whereby each part of its business has gone through significant transformation. The journey took on even greater visibility when ICD embarked on its strategic roadmap in 2010.

The ICD 10-year strategy approved and commenced in 2015, further confirms the direction taken. ICD has made it a priority to increase the availability and affordability of Islamic finance products for a wide range of financial institutions in member countries. Extending Line of Finance (LOF) to financial institutions, and investing in various types of financial institutional equity for the ultimate benefit of local real sector businesses, have proven to be critical tools for ICD in boosting the private sector and combating poverty in Member Countries.

Company: Islamic Corporation for the Development of the Private Sector (ICD)

Name: Top Management

Email: icd@isdb.org

Web: www.icd-ps.org

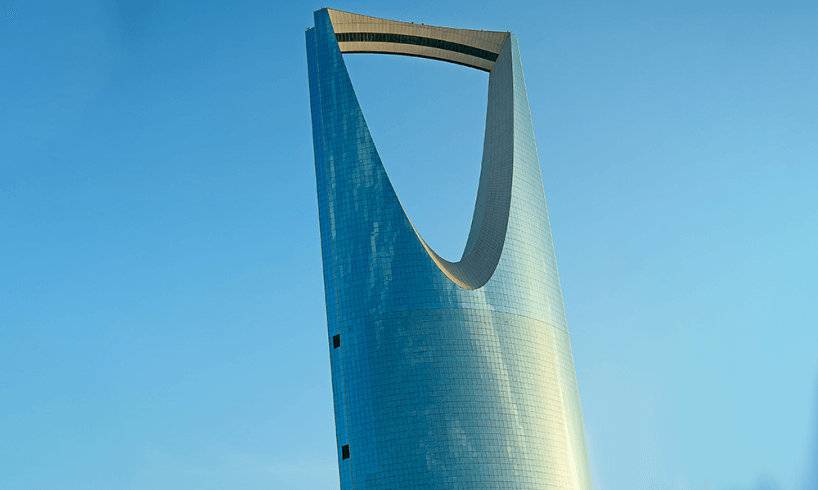

Address: P.O. Box 54069 Jeddah 21514, KSA

Phone: (966 12) 636 1400