High Street fashion retailer New Look has announced that Brait, South African billionaire Christo Wiese’s investment firm, has acquired a 90% stake in the business.

Brait will buy the stake from private equity firms Permira Holdings and Apax Partners for £780 million. Founder Tom Singh’s family and New Look management will own the remaining 10%.

Following the acquisition, New Look chief executive Anders Kristiansen, chief financial officer Mike Iddon and chief commercial officer Roger Wightman will remain with the business. The acquisition gives the company an enterprise value of circa £1.9 billion.

Commenting on this transaction, Kristiansen said: “Brait have a track record of long-term and supportive investments – they give us the perfect platform to continue our strategy of growing the New Look brand in the UK, Europe and China. I’d like to take this opportunity to thank our existing shareholders for their support over the years, and I am looking forward to working with Brait in the future.”

New Look operates 800 stores wordwide. Brait said it had strong growth prospects in France, Germany, Poland and especially China which is a priority market.

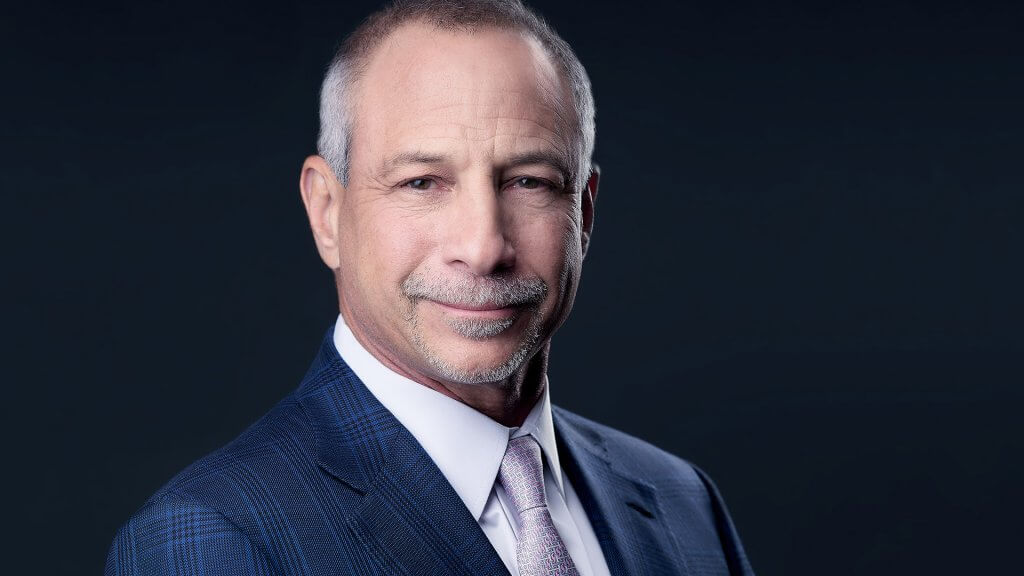

John Gnodde, chief executive of Brait, said: “New Look is an attractive investment opportunity for Brait. It is a market leading brand, with a strong track record of double digit EBITDA growth, solid cash flow conversion, international reach, and the potential to grow rapidly in a number of geographic markets including China. We have been highly impressed with the management team and look forward to partnering with them.”